A cloud-native e-invoicing solution built for modern finance teams

Global e-invoicing made eezi

Simplify global compliance, automate workflows, and scale globally – without disrupting any existing workflows

Purposefully crafted for modern finance teams

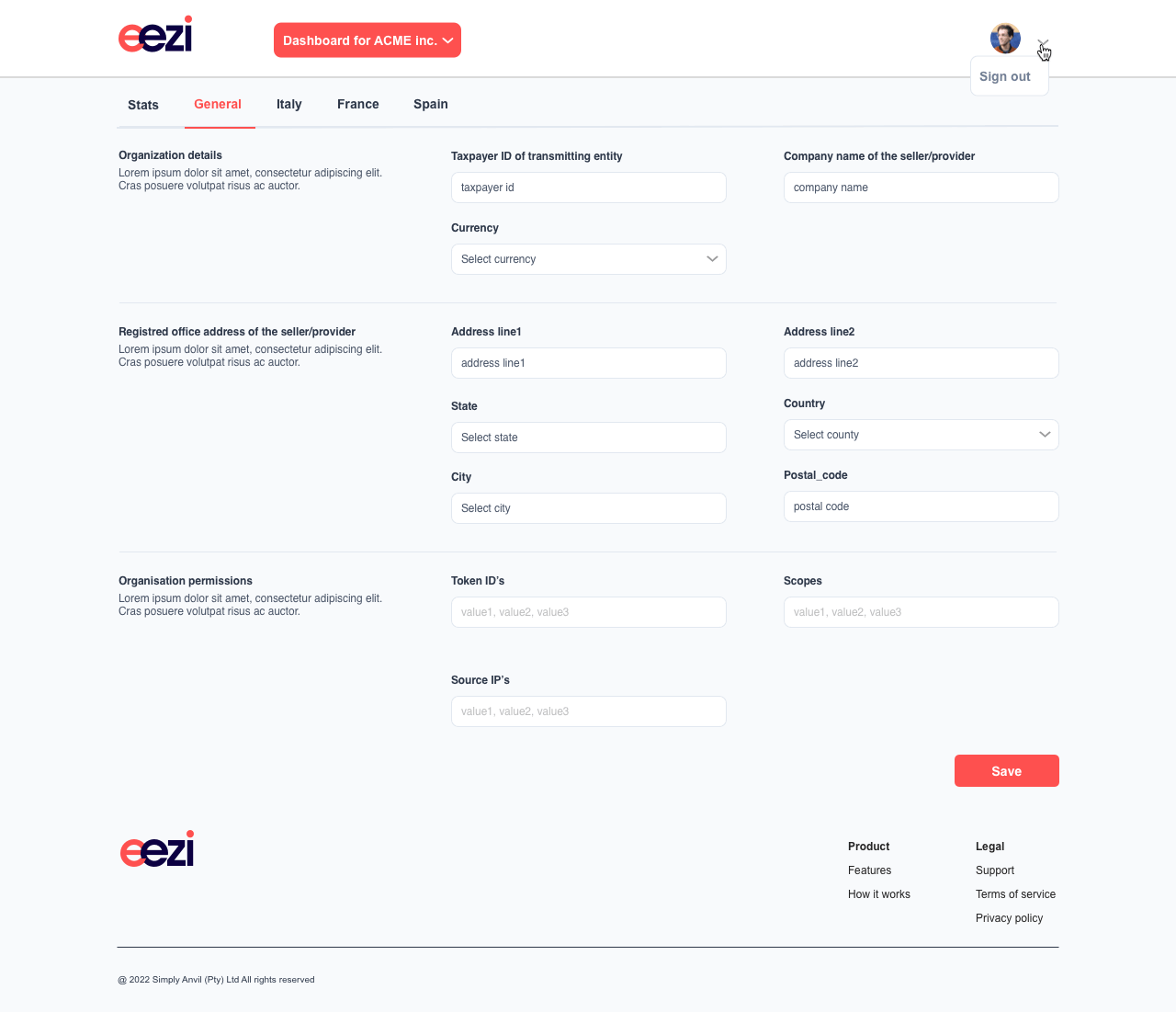

Eezi powered by VAT IT helps to make global e-invoicing and e-reporting requirements simple and seamless for your business.

Global E-Invoicing Compliance

Ensure seamless electronic invoicing across multiple jurisdictions, adhering to local tax authority requirements

Seamless System Integration

Integrate eezi with your existing ERP, EMS, CRM, and accounting systems, through multiple integration methods, for real-time data exchange, enhancing operational efficiency.

Simplified Compliance

Tame the complexities of international e-invoice and e-reporting legislation with an intuitive, future-ready compliance solution.

Navigate Global E-Invoicing Mandates with Confidence

Electronic invoicing and reporting mandates are rapidly expanding globally. These regulations range from structured data reporting to tax offices, invoice pre-clearance requirements, and fully automated real-time processing. These continuous transaction controls (CTCs) constantly evolve, requiring specialized systems integrated with tax platforms and supporting various e-invoicing formats and specifications.

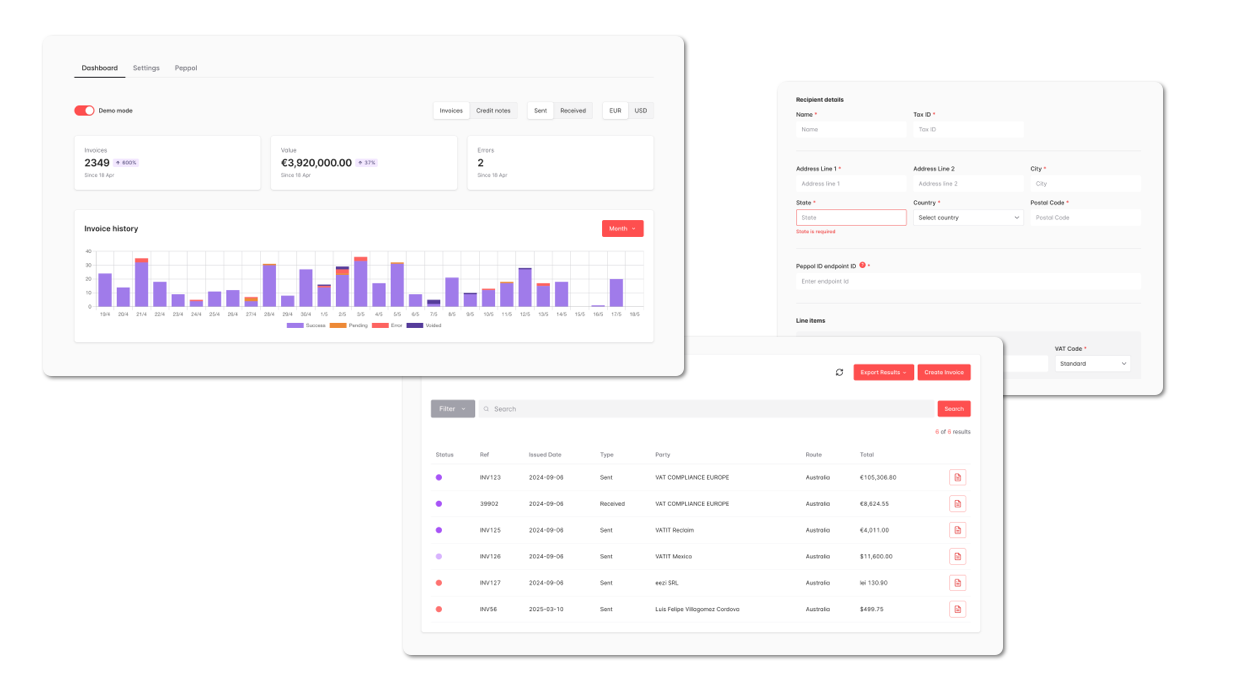

Features that matter

A Platform That Thinks Ahead

Our intelligent system ensures accuracy and reliability while working silently in the background—promptly identifying potential issues and alerting you only when necessary, so you can focus on your business.

Automatic Currency Conversion

Handle international transactions without manual calculations or conversions.

Eliminate Language Barriers

Automatic translation across documents - no multiple versions required.

Impactful AI where it Matters

System intelligence enhances submissions and reduces manual interventions.

Single Format Convenience

Simplifies integration with one universal document standard.

Preserve Your Workflow

Continue working as usual—with targeted alerts and digests

Smart Error Recovery

Spot problems accurately and resolve them with minimal effort.

Flexible ingestion options at any scale

A platform that adapts as your demand grows

Our invoice ingestion options scale from small team simplicity to enterprise-grade complexity. Whatever your business demands—occasional submissions or cross-continent operations—we've engineered a practical solution that would fit you.

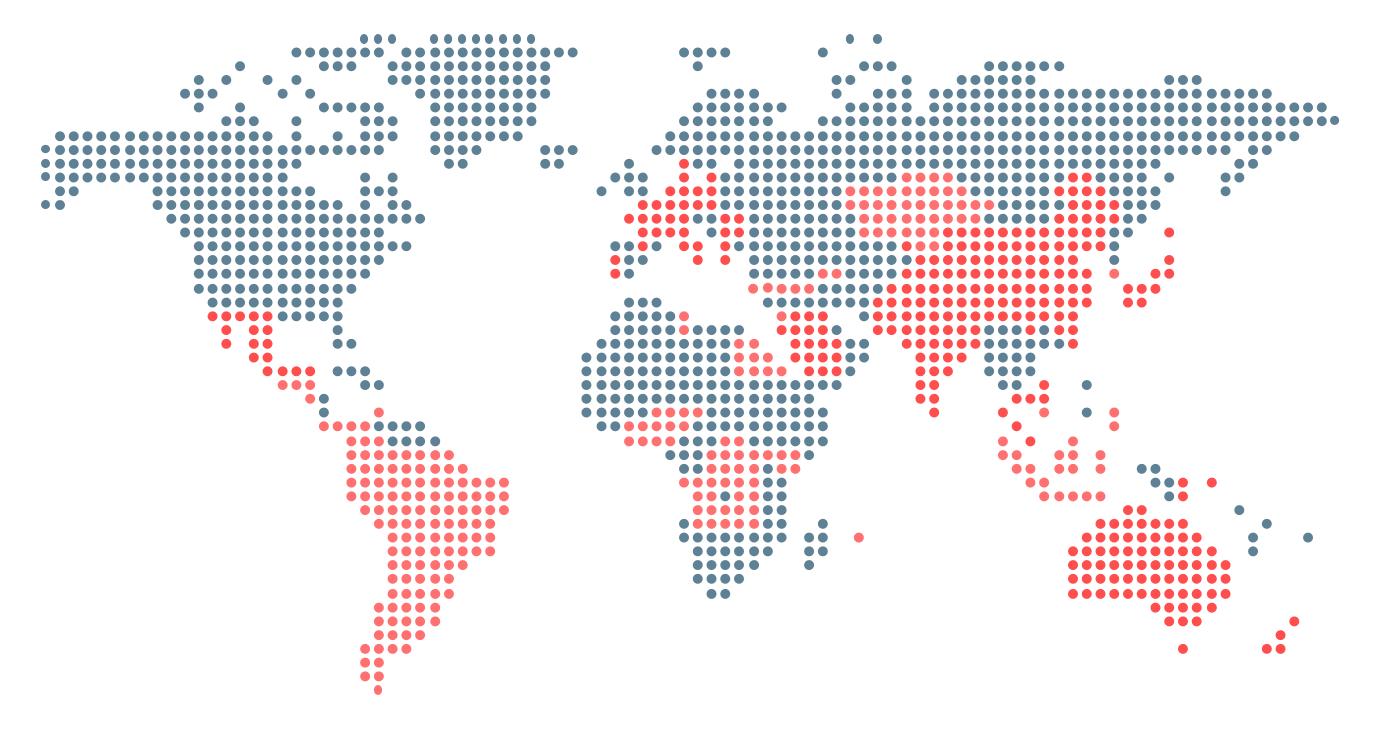

Global Reach

We support e-invoicing compliance across EU, APAC, EMEA and LATAM through a single global integration. Our dedicated regulatory team monitors current and upcoming requirements, while our developers build solutions that truly meet client needs.

Our platform is continuously updated to accommodate new countries and evolving regulations, ensuring your business remains compliant wherever you operate.

Upgrade to Effortless e-Invoicing

Experience the simplicity and efficiency of eezi's e-invoicing solution. Join the growing number of businesses transforming their invoicing processes with our intuitive platform.

Contact us.

Whether you are seeking to streamline your business operations, enhance your productivity, or explore new possibilities, our team is ready to partner with you every step of the way. We invite you to take the next step by contacting us today. Let us transform your vision into reality and embark on a journey of success together.

Frequently asked questions.

Common questions asked by our customers.

There are no limits to the number of users you can add to an organization.

eezi supports TOTP (Time-based One-Time Password) multi-factor authentication (MFA) for all user accounts.

Experienced bottlenecks are primarily due to administrative issues. Key issues include obtaining digital certificates and registering credentials for e-invoicing. In-country experts help expedite the process, but many aspects rely on designated providers, such as Tax Offices.

At eezi, we support multiple integration methods to speed up the process. All integration work is performed in-house by a team with extensive experience. We focus on eliminating complexities, making integration quick and seamless. eezi was built from scratch and is not based on legacy systems.

Yes, eezi can include custom fields if needed. The system is designed to be lean, starting with required fields and adding common fields for most business scenarios. Custom fields can be added during integration as an additional project.

Yes, eezi fully complies with regulations such as eIDAS (910/2014) in the EU and others mandated by tax offices. The required digital seal, token, signature, timestamp, or QR code will be provided as part of our service during onboarding.

Yes, eezi can handle any currency and accurately convert it to the local currency, following local rules when required by Tax Offices. Users can select the currency for reporting, and the appropriate conversion will be done.

Yes, all details are reported at the line item level, as required by Tax Offices.

eezi provides daily digest emails with an overview of documents sent/received, dashboards displaying volumes and values over user-selected periods, and data export functionality in CSV format.

Yes, each e-invoice is viewable as a human-readable PDF for easy reference, downloading, and sharing.

AP and AR invoices are segregated using an "invoice type" field. AR invoices are marked as "sent," while AP invoices are marked as "received." The same applies to credit notes.

- Data mismatches with the expected semantic data model. eezi proactively notifies clients of discrepancies before the Tax Office sends notifications.

- Payload request failures to the Tax Office due to technical issues.

- API delays in response or notification.

Yes, our API has a "list" function for invoices and credit notes (both AR and AP) to allow for an automated pull of these documents.

Yes, multiple users can be logged on at the same time.

Yes, user rights are configurable.

©2026 All rights reserved.

Cookie Consent

To give you the best experience, we use cookies for personalization and analytics.